Technology continues to shape the landscape of education, according to our latest K-12 payments research report. Modern payment systems are driving much of this change with their efficiency, ease of use, and improved security. Families get an easier way to pay school fees, fund meal accounts, and receive important school updates. With widespread digital payment system adoption, schools can in turn reduce the administrative burdens of handling cash, help drive down meal debt, a top concern among food service leaders in 2024, and outstanding fee balances, and improve family engagement.

To gain insights into the current state and usage of K-12 payment systems, we partnered with a third-party research company. They conducted a comprehensive survey, engaging with 1,250 K-12 professionals and families. Their valuable feedback highlighted desired aspects of the payment experience and unveiled areas that need improvement. The report provides valuable insight to help bridge the gap between family expectations and school and district priorities. Education leaders can use this information to inform strategic goals such as operational simplification, heightened efficiency, and fortified payment security.

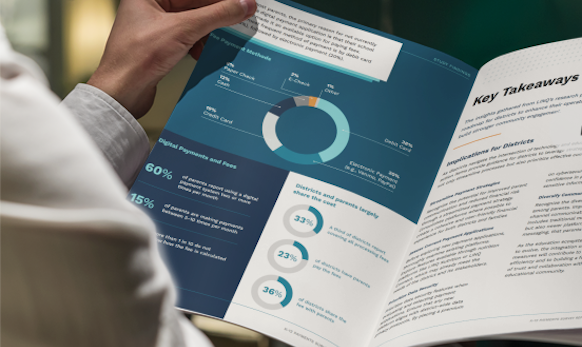

Here are five key takeaways from the full report:

1. Districts want to go cashless

A clear desire to go cashless resonated strongly among K-12 professionals surveyed. A majority expressed a strong inclination toward digital payments in the future. Urban districts, in particular, lead the charge with 77% expressing their desire to move away from processing cash and check payments. It’s one of the top school nutrition trends trends we’ve noticed both in this survey and in our discussions with K-12 leaders nationwide.

Problems related to processing cash payments appear to drive this trend. About 60% of districts included in the survey indicate experience with cash payment pitfalls. For many, this represents familiar troubles like lost payments and payment receipts, time-consuming trips to the bank, and difficulties adhering to cash-on-hand limits. The amount of cash coming in each day can vary widely, so remaining below the maximum cash allowed on a campus before it’s deposited at the bank adds a layer of unpredictability to daily operations.

2. Families see digital payments as an improvement

Digital payments can make life easier for families navigating their students’ educational journey. From fees around enrollment to school sports, library charges, and meal purchases, it all adds up to a lot to remember. Parents view digital payments as an improvement of their school experience. Many indicate that they use school payment systems at least twice per month. The survey results also reveal that electronic payments, like credit and debit cards, already make up about 80% of all payments made. Just 18% of payments are made using cash or check, according to respondents.

Families take advantage of digital payment options for much more than just funding student meal accounts. Many respondents report using digital systems to pay for sports activities, field trips, and school events, showing widespread adoption. This broad range of cashless payments shows that families will use a digital payments system for a variety of payments when given the option.

3. Families want an easy way to make payments

Simplicity is a top priority for parents surveyed. School fee management can get complicated for families, especially when they have more than one student across multiple schools. It’s no wonder they’re eager for an easier way to make payments, track payments, and stay up to date with finance-related school communications. In addition to making it easier to pay, an intuitive, modern digital payment system can make it much easier for families to keep track of fee due dates and search records of what’s already been paid.

However, school and district leaders express interest in expanding the number of payment apps they use. While this may represent a desire to advance their objective of going cashless, using separate digital payment systems for different kinds of fees and payments can quickly make life more difficult for families. Adopting a single, highly capable digital payments system can give districts the ability to process more digital payments while also giving families just one app to download instead of several. This is crucial to consider given parents’ high prioritization of simplicity.

4. Data security remains a top priority for families and districts

As technology advances, so does the importance of data security. Cybersecurity firm SonicWall cites a 275% rise in cyberattacks on school districts in 2022. Ranking as one of their top priorities collectively, 85% percent of parents emphasize the importance of security controls. Cybersecurity threats are on the rise. With an average of one incident per day on K-12 systems across the U.S., payment security is imperative. A data breach jeopardizes student, family, and staff data privacy. It can also result in significant operational disruptions for a school district, costing millions of dollars and negatively impacting student learning.

The report clearly reflects the importance of choosing a modern payment system with trustworthy security controls. To drive wide adoption by families, districts need to offer a payment system they’re comfortable entrusting with their personal and financial data.

5. Fees and meal accounts can (and should) be managed with a single digital solution

Simplifying the lives of parents and streamlining school operations with a single system enables K-12 leaders to pursue their objectives while satisfying families’ needs and expectations. A single modern solution for managing school fees and meal accounts streamlines school financial management and gives families an easy, secure payment tool.

LINQ Payments offers schools and districts the single solution they need to handle both student meal accounts and fee management. Plus, it delivers an intuitive, secure payment experience for families. It’s the technology answer to schools’ desire to move toward a cashless future while meeting families’ expectations and strengthening data security.

Dive into the full report now.

Get your free copy of this new research report to find out what’s driving change in K-12 nutrition, glimpse the future of K-12 payments, and find out how to deliver a better, more engaging experience for families.